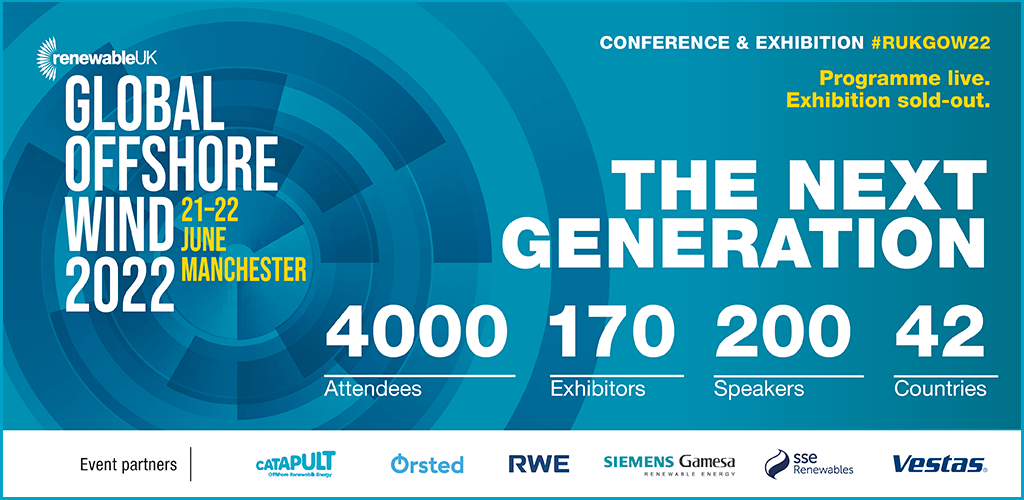

Global Offshore Wind

This is the largest dedicated UK offshore wind event to gain valuable market insights and practical business strategies designed to support the fight against climate change. Following COP26, GOW22 will keep net zero targets at the forefront of the industry. Don’t miss outstanding value, flexible booking, two conference streams, new theatres and networking with 4,000+ people.

Come and celebrate 20 years of GOW!

Find out more: https://events.renewableuk.com/gow22

Speakers

To be announced

Partnered With