Market to watch: Africa

Winds of change are blowing in Africa

by Karin Ohlenforst, Director of Market Intelligence, and Jon Lezamiz, Chair of GWEC Africa Taskforce

The African continent is set for growth, the population is expected to grow by 1.4% each year until 2030. GDP is expected to grow by 4%. This development is demanding huge investments in infrastructure including the energy markets to keep up with the growth, access to electricity being one of the main challenges African citizens consider to encompass and unlock their growth path. African governments have acknowledged that growth can only be supported through sustainable solutions, which means an obvious opportunity for wind energy. Offering a cost-competitive solution, wind energy has the potential to drive not only the electrification level in Africa (currently only 43% of people living in Sub-Saharan Africa have access to electricity according to the World Energy Outlook 2018 from IEA),but to also support the economic growth and development of African markets.

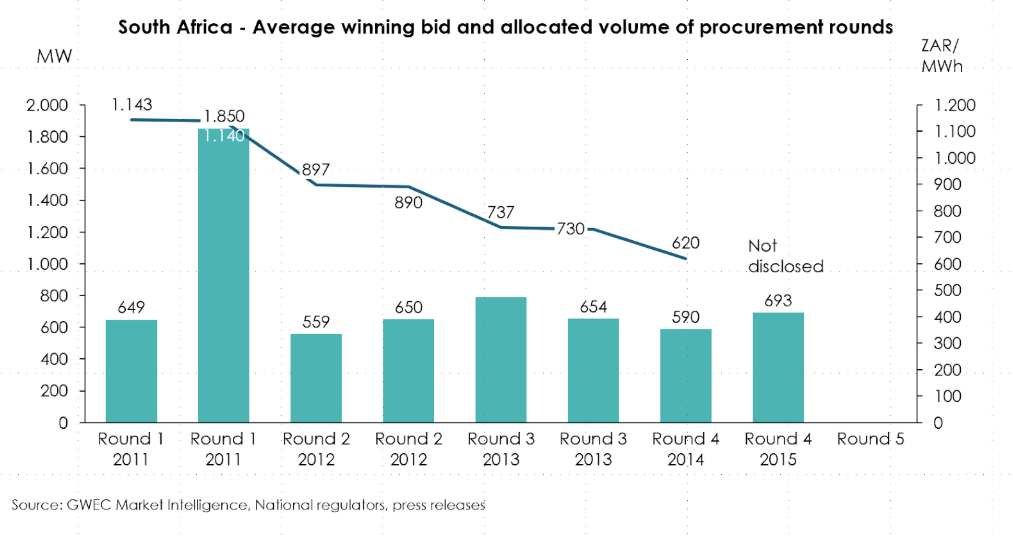

With now over 5GW of installed onshore wind energy, the majority of them installed during the recent three years, there has been good progress. Still, the share of wind energy in the energy mix of the African continent is around 1% (IEA WEO 2018), as thermal and hydro power still dominate. Despite this low share, several governments have committed to increase the share of wind and renewable energy over the next years. Wind energy resources Africa is endowed with are among the best in the world (100GW potential, according to IRENA REMAP 2030 report). Kenya certainly sticks out here with the target to become 100% renewable by 2020 (this includes hydropower). Other examples are Ethiopia with a target above 1GW of wind energy by 2020 and 2,5GW by 2030; Egypt with 22% of renewables by 2022. Morocco, 52% from renewable sources by 2030. Tunisia 30% also by 2030. Similar to other emerging wind markets, there are different allocation programs in place to reach the targets and there is not a common trend: Egypt and Kenya offer a Feed-in-Tariff, while other markets offer auction or tenders, for example South Africa which has been running a solid procurement program (REIPPP) over the past years tendering over 6GW of capacity until today or, most recently, Tanzania launched a 200MW tender.

South Africa’s Renewable Energy Independent Power Procurement Programme (REIPPP) is an example of a locally designed and implemented program for enabling increased supply of renewable energy and combating climate change. It has been described as “the most successful public-private partnership in Africa in the last 20 years” and is contributing to the country’s target of producing 7000 MW of renewable energy by 2020 and 17,800 MW by 2030. REIPPP has grabbed attention of both local and global leading wind players, while developing a local value chain. (source: https://www.senseandsustainability.net/2019/04/02/south-africas-reippp/)

In South Africa, over 2GW of wind energy have been installed so far. However, the market has stalled: For once, the state-owned utility Eskom is facing financial challenges which impacts the signing of PPAs for already tendered capacity. Further, a revision of the Integrated Resource Plan (IRP) is still outstanding and will provide more clarity about the future volume expectations for wind energy; and thus, the expected volume for future procurement rounds. During 2018 and 2019 (so far) no new wind capacity has been connected in South Africa. However, based on current market activity, GWEC Market Intelligence expects new installations to commence again during 2020 and onwards realizing the already tendered capacity. The country needs this new capacity and wind energy is most competitive source. A next procurement round is expected once the IRP is confirmed.

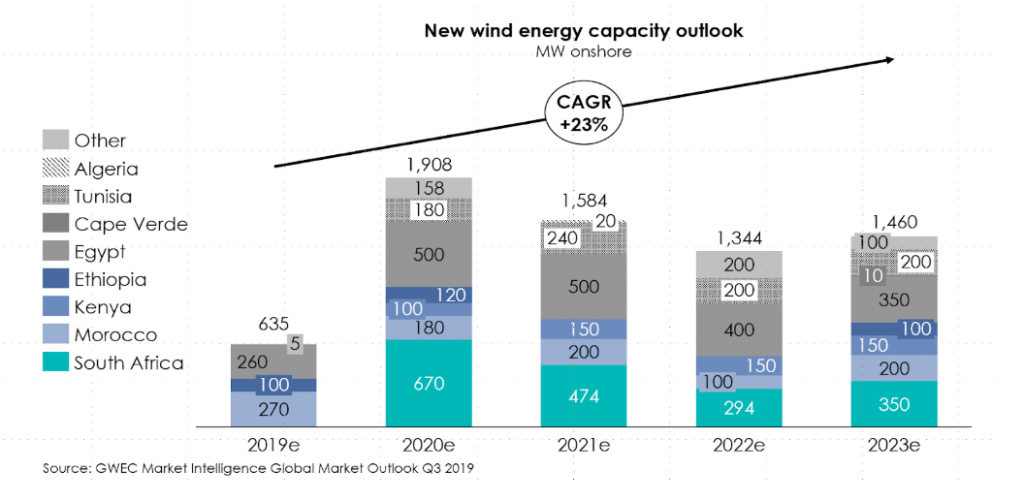

GWEC Market Intelligence expects 7GW of new capacity to be installed until 2023 and expects South Africa to continue to take a leading role.

This scenario is based on government targets and current project activities. This forecast proposes that the total installed base of wind energy would more than double on the African content until 2023. GWEC Market Intelligence, however, sees materially higher potential based on governments fulfilling their targets; fostering regional integration and the role of regional power pools; available wind resources; momentum that Africa is living and consequent Africa-focused initiatives that are being launched and the wind’s cost-competitive position to drive economic growth in Africa. The absence of both long term energy planning and supportive frameworks and an equal playing field compared to other energy sources, is hindering wind to fulfill its potential. This includes access and investments to transmission, lack of dispatch principles to prioritize wind energy as well as keeping fossil fuel subsidies – which are common bottlenecks in emerging and developing markets across the world. Often also organizational structures of the energy sector result in a bias towards non-renewable energy and also close opportunities for private investments.

GWEC’s Africa Task Force is working to promote the case of wind energy for the African content, highlighting benefits such as provision of clean and sustainable energy solutions while enhancing development of a sustainable local value chain. To ensure a fact-based and insightful discussion, GWEC has put together the Africa Handbook which shares experiences and insights on wind energy. The Africa Handbook is based on input from GWEC’s members and partners displaying the knowledge of the wind industry along all areas. To access the Africa Handbook, click here.